Asigură-te

că ai instalat

deja

aplicația de

mobile

banking

Atenție la noua tipologie de fraudă de tip spoofing, ce presupune utilizarea frauduloasa a numerelor de telefon asociate BRD. Persoane care pretind că sunt angajați ai băncii falsifică, cu ajutorul unor softuri, numerele de telefon asociate cu BRD (ex: TelVerde sau numerele de urgență carduri ), în cadrul unor apeluri telefonice în care se solicită date personale sau confidențiale. Este important să nu dați curs unor solicitări de divulgare date confidențiale, indiferent de pretextul invocat de apelant. Rămâi vigilent și raportează-ne imediat situațiile suspecte accesând serviciul MyBRD Contact.

×Economisire și investiții

Economisire și investiții

Noutăţi

Aici gasiti stiri si materiale legate de actualitatea noastra : de la comunicate de presa business pana la proiectele din domeniul cultural, din educatie, sport sau tehnologie

Anunţuri de mentenanţă

Aici anuntam toate lucrarile de mentenanta intreprinse in scopul imbunatatirii performantei serviciilor noastre.

Scena 9

Este o platforma de jurnalism cultural care face portretul tinerei generatii de creatori.

Școala 9

Este un proiect editorial dedicat educației preuniversitare creat de DoR și BRD.

Mindcraft Stories

Publicație online despre știință & tehnologie, ca să înţelegem lumea în care trăim

Drumul banilor

Este un proiect de educație financiară, un ghid de folosire eficientă a banilor noștri.

Filialele şi societăţi asociate

Contact Investitori

Cultura

Investim in cultura pentru ca este nevoie de lideri şi proiecte care să ne reamintească de unde venim, cine suntem şi încotro ne ducem.

Educatie

Ne propunem să investim in profesori, pentru că aceștia sunt cei care pot schimba, in timp, educatia din Romania .

Sport

Iubim sportul pentru ca ne ofera o calatorie pasionanta, cu momente frumoase, momente mai grele, cu eroi care castiga, isi atrag fani sau dimpotriva se lupta cu momente dificile.

Mediu

Dezvoltarea economică nu se mai poate construi fără progres în domeniul mediului sau social. Este misiunea noastră să propunem modele de transformare pozitivă a lumii în care trăim.

Societate civilă

Implicarea in comunitate are ca obiective construirea de mecanisme durabile de interventie astfel incat copii si tinerii aflati in situatii dificile sa poata sa isi dezvolte abilitatile.

Lumea 9

Dezvoltăm și finanțăm proiecte, companii, afaceri pentru lumea de azi și cea de mâine. Pentru o lume curajoasă, care pune în centrul ei grija pentru planetă, dar și pentru oameni.

Mindcraft Academy

Programul care te ajută să faci puțină lumină în perspectivele tale. Să înveți ce îți place și apoi să faci ce-ți place.

Descoperă

Cunoaşte

Aplică

Online trading

Echipa noastră

Alte informaţii

SMS banking

Serviciu ce îți oferă informații despre conturile bancare direct de pe telefonul mobil

Serviciu ce îți oferă informații despre conturile bancare direct de pe telefonul mobil

Află detalii »Aici gasiti stiri si materiale legate de actualitatea noastra : de la comunicate de presa business pana la proiectele din domeniul cultural, din educatie, sport sau tehnologie

Află detalii »Aici anuntam toate lucrarile de mentenanta intreprinse in scopul imbunatatirii performantei serviciilor noastre.

Află detalii »Este o platforma de jurnalism cultural care face portretul tinerei generatii de creatori.

Află detalii »Este un proiect editorial dedicat educației preuniversitare creat de DoR și BRD.

Află detalii »Publicație online despre știință & tehnologie, ca să înţelegem lumea în care trăim

Află detalii »Este un proiect de educație financiară, un ghid de folosire eficientă a banilor noștri.

Află detalii »Investim in cultura pentru ca este nevoie de lideri şi proiecte care să ne reamintească de unde venim, cine suntem şi încotro ne ducem.

Află detalii »Ne propunem să investim in profesori, pentru că aceștia sunt cei care pot schimba, in timp, educatia din Romania .

Află detalii »Iubim sportul pentru ca ne ofera o calatorie pasionanta, cu momente frumoase, momente mai grele, cu eroi care castiga, isi atrag fani sau dimpotriva se lupta cu momente dificile.

Află detalii »Dezvoltarea economică nu se mai poate construi fără progres în domeniul mediului sau social. Este misiunea noastră să propunem modele de transformare pozitivă a lumii în care trăim.

Află detalii »Implicarea in comunitate are ca obiective construirea de mecanisme durabile de interventie astfel incat copii si tinerii aflati in situatii dificile sa poata sa isi dezvolte abilitatile.

Află detalii »Dezvoltăm și finanțăm proiecte, companii, afaceri pentru lumea de azi și cea de mâine. Pentru o lume curajoasă, care pune în centrul ei grija pentru planetă, dar și pentru oameni.

Află detalii »Programul care te ajută să faci puțină lumină în perspectivele tale. Să înveți ce îți place și apoi să faci ce-ți place.

Află detalii »Schimb valutar în cont

Cod valută

EUR

USD

GBP

Cump. BRD (RON)

4.9020

4.5870

5.6710

Vânz. BRD (RON)

5.0480

4.7560

5.8580

Moneda

EURO

EURO

DOLAR SUA

DOLAR SUA

LIRA STERLINA

LIRA STERLINA

Cod valută

EUR

USD

GBP

Curs mediu calculat de BNR

4.9758

4.6712

5.7677

Cump. BRD (RON)

4.9020

4.5870

5.6710

Vânz. BRD (RON)

5.0480

4.7560

5.8580

Moneda

EURO

EURO

DOLAR SUA

DOLAR SUA

LIRA STERLINA

LIRA STERLINA

Cod valută

EUR

USD

GBP

Curs mediu calculat de BNR

4.9758

4.6712

5.7677

Cump. BRD (RON)

4.8980

4.5750

5.6460

Vânz. BRD (RON)

5.0520

4.7680

5.8830

Moneda

EURO

EURO

DOLAR SUA

DOLAR SUA

Cod valută

EUR

USD

Curs mediu calculat de BNR

4.9758

4.6712

Cump. BRD (RON)

4.9030

4.5810

Marja vs. Curs BCE

1.37%

0.37%

Vânz. BRD (RON)

5.0490

4.7500

Marja vs. Curs BCE

1.57%

4.08%

Milioane de clienți

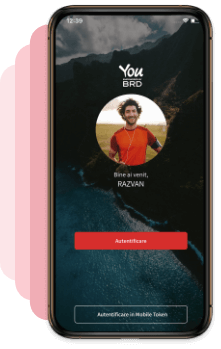

clienti YOU BRD

Miliarde credite lei

Miliarde depozite lei

companii

Grup BRD

© 2024 BRD. Acest site este proprietatea BRD - Groupe Societe Generale. Toate drepturile rezervate.

© 2024 BRD. Acest site este proprietatea BRD - Groupe Societe Generale. Toate drepturile rezervate. Termenii și condițiile Hartă site

Dorim sa iti reamintim ca BRD – GSG nu a solicitat si nu va va solicita niciodata datele de autentificare (cod utilizator, parola sau parola token) sau datele confidentiale aferente cardului tau (numar card, data expirarii, cod de securitate sau PIN), nici telefonic si nici pe e-mail sau SMS.

Aceste date confidentiale se vor folosi doar in momentul autentificarii in aplicatia de internet banking sau in momentul efectuarii unei plati cu cardul bancar.

In acelasi timp, daca observi un aspect diferit de cel obisnuit al aplicatiei MyBRD Net sau un comportament pe care nu l-ai mai intalnit (ex. Un mesaj de notificare ca pagina este indisponibila si esti invitat sa te reautentifici sau sa iti resincronizezi dispozitivul token), opreste imediat procesul de autentificare si te rugam sa ne contactezi de urgenta prin MyBRD Contact la tel: 021 302 6161.

Intotdeauna alaturi de tine,

Banca ta. Echipa ta