Asigură-te

că ai instalat

deja

aplicația de

mobile

banking

Attention to the new typology of spoofing fraud, which involves the fraudulent use of phone numbers associated with BRD. People who claim to be employees of the bank falsify, with the help of some software, the phone numbers associated with BRD (eg: TelVerde or card emergency numbers), during phone calls in which personal or confidential data is requested. It is important not to comply with requests to disclose confidential data, regardless of the pretext used by the caller. Stay alert and report suspicious situations to us immediately by accessing the MyBRD Contact service.

×Online trading

Other services

News

News and related materials of our current activity: from business press releases to cultural, educational, sport or technological projects

Scene 9

is an online cultural publication that shapes the portrait of the new generation of creators

Scoala 9

is an editorial project dedicated to the pre-university education created by DoR and BRD

Our team

Subsidiaries and associated entities

Culture

We invest in culture because we need leaders and projects to remind us where we come from, who we are and where we are heading to.

Education

We strongly believe that the main driver for a higher performance of the education system is the quality of teachers. That’s why our majors programs are focussing on developping teachers’ skills.

Sports

We love sports because they provide us with an exciting journey with some beautiful moments, heroes who win, attract new fans or, on the contrary, struggle with difficult moments.

Environment

Economic development is no longer possible without environmental and social progress. It is our responsibility to propose business models that encourage the positive transformation of the world.

The Civil Society

Community involvement is designed to build sustainable intervention mechanisms so that children and young people in difficult situations can develop their skills

Financial Information

Depository services

Safekeeping, registering, monitoring and controlling the applications for subscription or redemption of fund units.

Issuer services

Distribution of fund units, dividends and bond payments. Group distribution services within public offerings.

Global and local custody services

Administration availability of customer accounts to their instructions - financial instruments operations or cash.

Clearing services

Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

Contact

Discover

Learn

Apply

Saving and investments

Saving and investments

Offers

SMS banking

The remote banking service provides you with information on your bank accounts directly from your mobile phone.

Useful

The remote banking service provides you with information on your bank accounts directly from your mobile phone.

Find out more »Safekeeping, registering, monitoring and controlling the applications for subscription or redemption of fund units.

Find out more »Distribution of fund units, dividends and bond payments. Group distribution services within public offerings.

Find out more »Administration availability of customer accounts to their instructions - financial instruments operations or cash.

Find out more »Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

Find out more »News and related materials of our current activity: from business press releases to cultural, educational, sport or technological projects

Find out more »is an online cultural publication that shapes the portrait of the new generation of creators

Find out more »is an editorial project dedicated to the pre-university education created by DoR and BRD

Find out more »Find here our mass media contacts

Find out more »We invest in culture because we need leaders and projects to remind us where we come from, who we are and where we are heading to.

Find out more »We strongly believe that the main driver for a higher performance of the education system is the quality of teachers. That’s why our majors programs are focussing on developping teachers’ skills.

Find out more »We love sports because they provide us with an exciting journey with some beautiful moments, heroes who win, attract new fans or, on the contrary, struggle with difficult moments.

Find out more »Economic development is no longer possible without environmental and social progress. It is our responsibility to propose business models that encourage the positive transformation of the world.

Find out more »Community involvement is designed to build sustainable intervention mechanisms so that children and young people in difficult situations can develop their skills

Find out more »We would like to inform you that there is a phishing action on e-mail and SMS, which targets BRD customers. This type of action aims at stealing personal data (name, CNP, phone number, etc.), card data and OTP validation codes (6-digit number received via SMS from BRD), with the purpose of unauthorized activation of the internet and mobile banking service YOU BRD. If you receive emails or text messages that do not appear to be from trusted sources, we recommend that you do not access the links, do not reply to incoming messages, do not open attachments, and do not provide any information.

Report any suspicions to us at mybrdcontact@brd.ro.

1. Obtaining access to your computer and your data by using malicious software

BRD NEVER asks for: your card number, application activation codes or PIN code. Data updates are operated in agencies, contact centers or by accessing the official website

2. Malicious people may contact you under various pretexts, such as representatives of a real organization, to request information or personal documents, including:

Avoid accessing links or attachments from unknown sources

Verify official sites before operating any type of transaction or online payment

Never reply to unsolicited emails, text messages (SMS) or phone calls from strangers requesting personal information without first checking the sender

Use unique and complex passwords for every online account, including email, and never share passwords or PINs

Enable 2FA (two-factor authentication) for enhanced security, wherever this option is available

Avoid the transmission of personal data and misuse. Ex: The card is a payment instrument, not a collection one. To collect money, use the 24-digit IBAN, not the 16-digit card code

Don't respond to mandatory requirements (eg closing a non-payment service subscription, paying a fictitious courier fee)

If you face such situations check the veracity directly on the suppliers' website or turn to dedicated customer service

Contact your Bank only at the number specified in the contract with it , in case you receive a message informing you that you have authorized a payment or confirming the completion of a transaction that you did not make.

Report any unexpected connectivity issues with your mobile service (inability to make calls, send text messages, etc.) to your service provider to ensure that you are not a victim of a SIM card fraud attempt.

* Phishing is a method of illegally obtaining confidential personal and financial data of victims by using methods of social manipulation consisting of impersonating trusted public or private institutions.

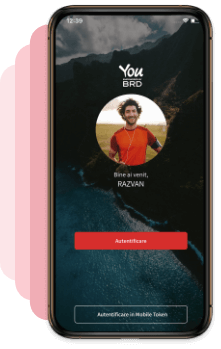

Please note that the internet and mobile banking application, YOU BRD, can be activated EXCLUSIVELY by downloading it from one of the stores dedicated to each manufacturer:

Remain vigilant when you want to sell a product and use various sites to run a sales ad, even when the sites are famous.

How does it work?

You have a product for sale and you want to promote it through an advertising site. Subsequently, you are contacted by phone or WhatsApp by potential buyers who seem to be interested in your product.

Careful!!! Fake shoppers are extremely clever and persuasive to get you to disclose your bank card access information , motivating you to get your money's worth much faster.

After a few discussions, you reach an agreement with the potential buyer, who tries to persuade you to accept his offer to receive payment by card. Thus, the fraudster asks you to provide directly on WhatsApp / SMS the confidential data related to your card or to access a link sent by it. If you access that link, a WEB page will appear, apparently belonging to the advertising site, but this site is completely controlled by fraudsters. This will ask you to enter the card details on which you would like to receive the money (eg card number, expiry date, CVV / CVC security code, 3D SECURE password received on your phone), including the registration / enrollment code of the card in the Apple Pay application (electronic wallet application). In fact, the fraudster captures all this critical data of access to your bank account and, implicitly, the control over your money. That way, you'll be able to pass on your sensitive data to fraudsters. Subsequently, based on this information, fraudsters can make various online payments, avoiding standard security filters.

How do we protect ourselves?

Please be vigilant, do not access the links provided by potential buyers and do not provide them with confidential data.

Various scams in the online environment

Online fraud is currently the most widely used type of scam internationally. The phenomenon is booming, correlated with the increase in the number of users and, at the same time, online transactions. The most common methods of fraud are:

Investment fraud which may include "opportunities" to invest in stocks, bonds or virtual currencies. Thus, various people guarantee you attractive earnings if you make various investments using certain trading platforms or transferring sums of money to accounts indicated by them. In reality, both platforms and accounts are controlled by fraudsters.

Inheritance / Unexpected Donation You are notified that a friend or relative has left you a fabulous amount of money, and all you have to do is pay a fee to transfer the money to the accounts indicated by the fraudsters.

How to protect ourselves:

Payer handling

How does it work?

The fraudster obtains access to electronic mail (e-mail) between two business partners. It tells the buyer that payment must be made to a new vendor account , which is actually controlled by the fraudster. In order to increase the degree of authenticity, a modified invoice is sent to the victim (containing the new account to which the payment is to be made), which is very similar to the authentic one. If the correctness of the information is not verified and the request is complied with, the buyer transfers the money to the account controlled by the fraudster.

Also, in other cases, the fraudster claims to be the legitimate representative of a supplier of goods and / or services and, in this capacity, requests the modification of payment dates so as to collect the value of the invoice in the accounts controlled by him.

The fraud can be identified late when the real supplier warns the buyer that he has not yet collected the value of the goods / services provided.

How do we protect ourselves?

If you receive information regarding the change of the supplier's / business partner's account, check the information (however credible the request may seem) and on another communication channel (eg by telephone).

BRD Group

© 2024 BRD. This site is property of BRD. All rights reserved.

BRD Group

© 2024 BRD. This site is property of BRD. All rights reserved. Terms and conditions Sitemap

We would like to remind you that BRD - Groupe Societe Generale has not requested and will never ask any of your authentication data (user code, password or password token) or confidential information related to your card (card number, expiration date, security code or PIN) by phone, nor e-mail or SMS.

These confidential data will be used only for the internet banking authentication or for online payments.

At the same time, if you notice a different appearance of the usual MyBRD Net application (ex. A notification message that the page is unavailable and you are invited to log in again, or to sync your token device), please stop the authentication process immediately and contact as soon as possible through MyBRD Contact tel: 021 302 6161.

Always with you,

Your bank. Your team