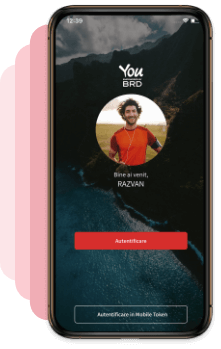

Asigură-te

că ai instalat

deja

aplicația de

mobile

banking

Attention to the new typology of spoofing fraud, which involves the fraudulent use of phone numbers associated with BRD. People who claim to be employees of the bank falsify, with the help of some software, the phone numbers associated with BRD (eg: TelVerde or card emergency numbers), during phone calls in which personal or confidential data is requested. It is important not to comply with requests to disclose confidential data, regardless of the pretext used by the caller. Stay alert and report suspicious situations to us immediately by accessing the MyBRD Contact service.

×Online trading

Other services

News

News and related materials of our current activity: from business press releases to cultural, educational, sport or technological projects

Scene 9

is an online cultural publication that shapes the portrait of the new generation of creators

Scoala 9

is an editorial project dedicated to the pre-university education created by DoR and BRD

Our team

Subsidiaries and associated entities

Culture

We invest in culture because we need leaders and projects to remind us where we come from, who we are and where we are heading to.

Education

We strongly believe that the main driver for a higher performance of the education system is the quality of teachers. That’s why our majors programs are focussing on developping teachers’ skills.

Sports

We love sports because they provide us with an exciting journey with some beautiful moments, heroes who win, attract new fans or, on the contrary, struggle with difficult moments.

Environment

Economic development is no longer possible without environmental and social progress. It is our responsibility to propose business models that encourage the positive transformation of the world.

The Civil Society

Community involvement is designed to build sustainable intervention mechanisms so that children and young people in difficult situations can develop their skills

Financial Information

Depository services

Safekeeping, registering, monitoring and controlling the applications for subscription or redemption of fund units.

Issuer services

Distribution of fund units, dividends and bond payments. Group distribution services within public offerings.

Global and local custody services

Administration availability of customer accounts to their instructions - financial instruments operations or cash.

Clearing services

Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

Contact

Discover

Learn

Apply

Saving and investments

Saving and investments

Offers

SMS banking

The remote banking service provides you with information on your bank accounts directly from your mobile phone.

Useful

The remote banking service provides you with information on your bank accounts directly from your mobile phone.

Find out more »Safekeeping, registering, monitoring and controlling the applications for subscription or redemption of fund units.

Find out more »Distribution of fund units, dividends and bond payments. Group distribution services within public offerings.

Find out more »Administration availability of customer accounts to their instructions - financial instruments operations or cash.

Find out more »Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

Find out more »News and related materials of our current activity: from business press releases to cultural, educational, sport or technological projects

Find out more »is an online cultural publication that shapes the portrait of the new generation of creators

Find out more »is an editorial project dedicated to the pre-university education created by DoR and BRD

Find out more »Find here our mass media contacts

Find out more »We invest in culture because we need leaders and projects to remind us where we come from, who we are and where we are heading to.

Find out more »We strongly believe that the main driver for a higher performance of the education system is the quality of teachers. That’s why our majors programs are focussing on developping teachers’ skills.

Find out more »We love sports because they provide us with an exciting journey with some beautiful moments, heroes who win, attract new fans or, on the contrary, struggle with difficult moments.

Find out more »Economic development is no longer possible without environmental and social progress. It is our responsibility to propose business models that encourage the positive transformation of the world.

Find out more »Community involvement is designed to build sustainable intervention mechanisms so that children and young people in difficult situations can develop their skills

Find out more »

Save time for your business using the automatic payment services!

PAYMENT service includes a wide range of benefits.

by authorizing repetitive operations

over the amounts transferred automatically through the possibility of setting a maximal ceiling

that invoices and other obligations are paid on time

by authorizing repetitive operations

over the amounts transferred automatically through the possibility of setting a maximal ceiling

that invoices and other obligations are paid on time

Automatic Payment Services offer the automatic processing from the account of the invoice payments and other repetitive transfers and services that help you simplify the payment process by automating the systematic transfers, as well as the payments of invoices for services and utilities.

Using the Simplis Debit service, the account is automatically debited at the initiative of the invoice issuer (the beneficiary of the amount) with the equivalent value of the invoice

Through the Standing Orders service, you have the initiative of the payment and you set its features (amount, frequency). The scheduled amount can be paid daily, weekly, twice a month or monthly.

The Simplis Debit service automatically debits the account at the initiative of the invoice issuer (the beneficiary of the amount) with the equivalent value of the invoice, whereas through the Standing Orders service the initiative of the payment and the setting of its features (amount, frequency) belongs to you.

Using the Simplis Debit service, the account is automatically debited at the initiative of the invoice issuer (the beneficiary of the amount) with the equivalent value of the invoice.

Payment of the salaries into the account is the ideal solution for your business if you wish to enhance the efficiency of the method of payment of the salaries and, at the same time, to provide your employees with access to bank products and services at advantageous prices and conditions.

How does the salary payment into a BRD account work?

The payment of the salaries into BRD accounts ensures the transfer by the company of the amounts owed to all the employees via a single payment order and an encrypted file.

The documents related to the transfer may be filed either at the counters of BRD units or may be sent by way of the Multix service.

What advantages do company employees have by the payment of their salaries into BRD accounts?

Starting December 15, 2019, we reduce and align the bank charges for companies:

More information can be found in the Fees and Commissions Guide.

*The list of countries included in SEPA (Single Euro Payments Area) can be found at the following link: https://www.europeanpaymentscouncil.eu

Further to United Kingdom’s decision to withdraw from the European Union, please be informed that the transition period afferent to Brexit will end on the 31st of December, 2020.

BRD will not raise the fees and commissions for the credit transfer operations – payments in RON and EUR initiated to beneficiaries located in UK. This means that the fees and commissions applicable to such transfers will be the same as those applicable to transfers towards beneficiaries located in the Single EURO Payment Zone (SEPA).

For cash withdrawals with BRD cards (Individual and Business Cards) from ATM/ POS initiated in UK, the fees will be those applicable to withdrawals outside European Union. For more details please consult the Tax and Commission guides available here.

| SEPA Commissions operations companies | download |

BRD Group

© 2024 BRD. This site is property of BRD. All rights reserved.

BRD Group

© 2024 BRD. This site is property of BRD. All rights reserved. Terms and conditions Sitemap

We would like to remind you that BRD - Groupe Societe Generale has not requested and will never ask any of your authentication data (user code, password or password token) or confidential information related to your card (card number, expiration date, security code or PIN) by phone, nor e-mail or SMS.

These confidential data will be used only for the internet banking authentication or for online payments.

At the same time, if you notice a different appearance of the usual MyBRD Net application (ex. A notification message that the page is unavailable and you are invited to log in again, or to sync your token device), please stop the authentication process immediately and contact as soon as possible through MyBRD Contact tel: 021 302 6161.

Always with you,

Your bank. Your team