Asigură-te

că ai instalat

deja

aplicația de

mobile

banking

Beware of fake calls! ANAF, the bank or other authorities do not ask you to provide bank details or access codes, nor to access various links, which may lead to the installation of remote control applications on your computer. Do not perform "test banking transactions" and do not accept such requests received by phone, it may be a fraud! Contact your banking advisor immediately and report suspicious situations!

×Daily banking

YOU

SMS banking

The remote banking service provides you with information on your bank accounts directly from your mobile phone.

MyBRD Contact

MyBRD Contact is a service which allows you to quickly make your current operations through the phone.

Other services

Saving and investments

Offers

SME<sup>1-50M Euro</sup>

Online trading

Other services

Our team

Depository services

Safekeeping, registering, monitoring and controlling the applications for subscription or redemption of fund units.

Issuer services

Distribution of fund units, dividends and bond payments. Group distribution services within public offerings.

Global and local custody services

Administration availability of customer accounts to their instructions - financial instruments operations or cash.

Clearing services

Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

Contact

Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

News

News and related materials of our current activity: from business press releases to cultural, educational, sport or technological projects

Scene 9

is an online cultural publication that shapes the portrait of the new generation of creators

Școala 9

is an editorial project dedicated to the pre-university education created by DoR and BRD

Subsidiaries and associated entities

Culture

We invest in culture because we need leaders and projects to remind us where we come from, who we are and where we are heading to.

Education

We strongly believe that the main driver for a higher performance of the education system is the quality of teachers. That’s why our majors programs are focussing on developping teachers’ skills.

Sports

We love sports because they provide us with an exciting journey with some beautiful moments, heroes who win, attract new fans or, on the contrary, struggle with difficult moments.

Environment

Economic development is no longer possible without environmental and social progress. It is our responsibility to propose business models that encourage the positive transformation of the world.

The Civil Society

Community involvement is designed to build sustainable intervention mechanisms so that children and young people in difficult situations can develop their skills

Financial Information

Discover

Learn

Apply

The remote banking service provides you with information on your bank accounts directly from your mobile phone.

Find out more »MyBRD Contact is a service which allows you to quickly make your current operations through the phone.

Find out more »Safekeeping, registering, monitoring and controlling the applications for subscription or redemption of fund units.

Find out more »Distribution of fund units, dividends and bond payments. Group distribution services within public offerings.

Find out more »Administration availability of customer accounts to their instructions - financial instruments operations or cash.

Find out more »Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

Find out more »Clearing services for transactions made on Bucharest Stock Exchange, Bucharest Clearing House and SIBEX.

Find out more »News and related materials of our current activity: from business press releases to cultural, educational, sport or technological projects

Find out more »is an online cultural publication that shapes the portrait of the new generation of creators

Find out more »is an editorial project dedicated to the pre-university education created by DoR and BRD

Find out more »Find here our mass media contacts

Find out more »We invest in culture because we need leaders and projects to remind us where we come from, who we are and where we are heading to.

Find out more »We strongly believe that the main driver for a higher performance of the education system is the quality of teachers. That’s why our majors programs are focussing on developping teachers’ skills.

Find out more »We love sports because they provide us with an exciting journey with some beautiful moments, heroes who win, attract new fans or, on the contrary, struggle with difficult moments.

Find out more »Economic development is no longer possible without environmental and social progress. It is our responsibility to propose business models that encourage the positive transformation of the world.

Find out more »Community involvement is designed to build sustainable intervention mechanisms so that children and young people in difficult situations can develop their skills

Find out more »Find below the answers to the most frequently asked questions about BRD @ffice:

Yes, by using the BRD@ffice Mobile app, available in Play/AppStore for devices having iOS or Android* OS. The BRD@ffice Mobile app could be used to view account data and sign transactions initiated via the BRD@ffice site/MultiX app.

* Having Google Play access.

Because BRD@ffice is available 24/7*, the intra-banking transfers are processed in real-time, daily, until 21:30, including in weekend, according to the communicated cut-of times.

* except for the 1:30- 2:30 AM interval when the service is stopped for maintenance

Sure. You can process payments towards any beneficiary, no matter the bank where the account is resident, if the foreign exchange regime is respected and that the minimum details to process the payment are known, depending on the transfer type. If you need more details, please call the Help Desk Cash Management support service, by using the contact data displayed on the site.

There is no maximum number of designated users.

Yes, you can segregate the rights of each user by filling the BRD@ffice appendix.

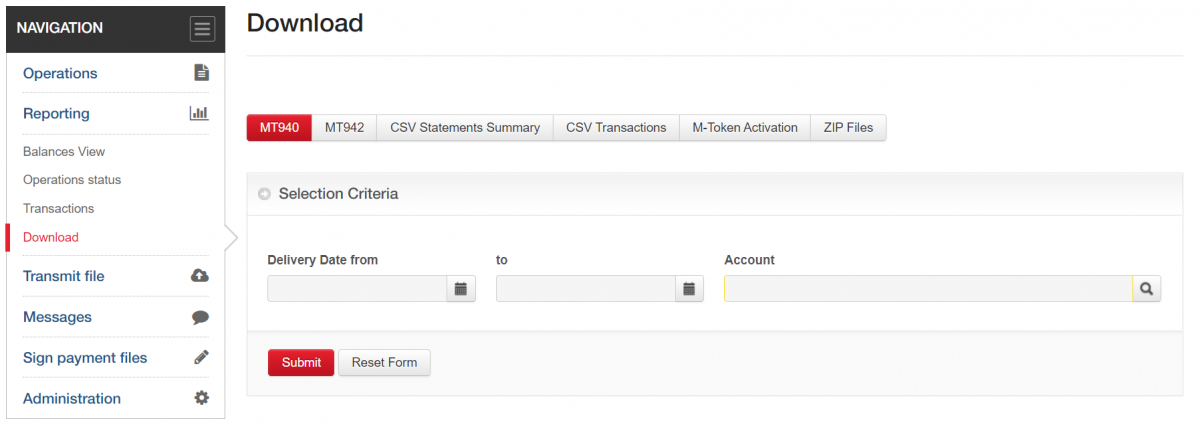

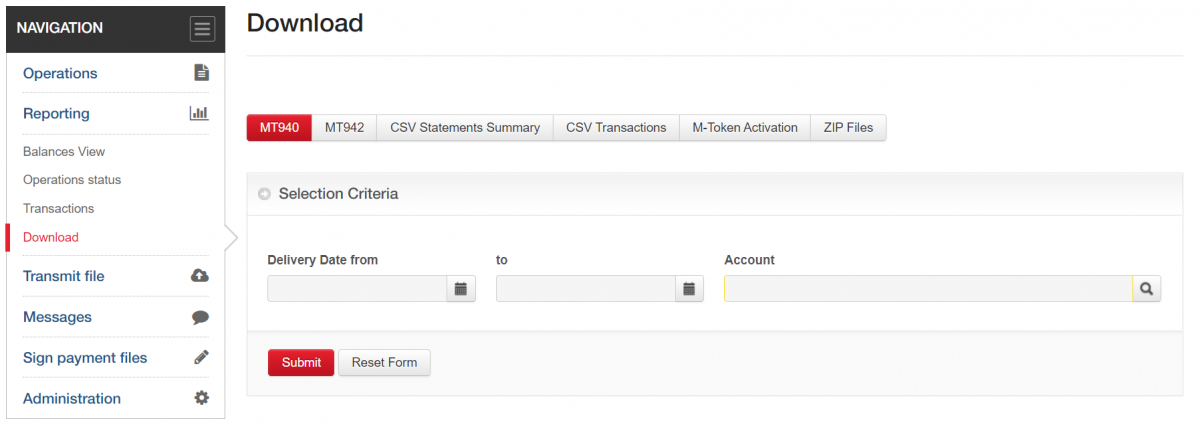

Yes, by accessing the Reporting → DOWNLOAD menu and selecting the format (MT940/MT942/CSV/CAMT.053-XML/CAMT.052-XML), the account and the interval, as you can view in the below picture

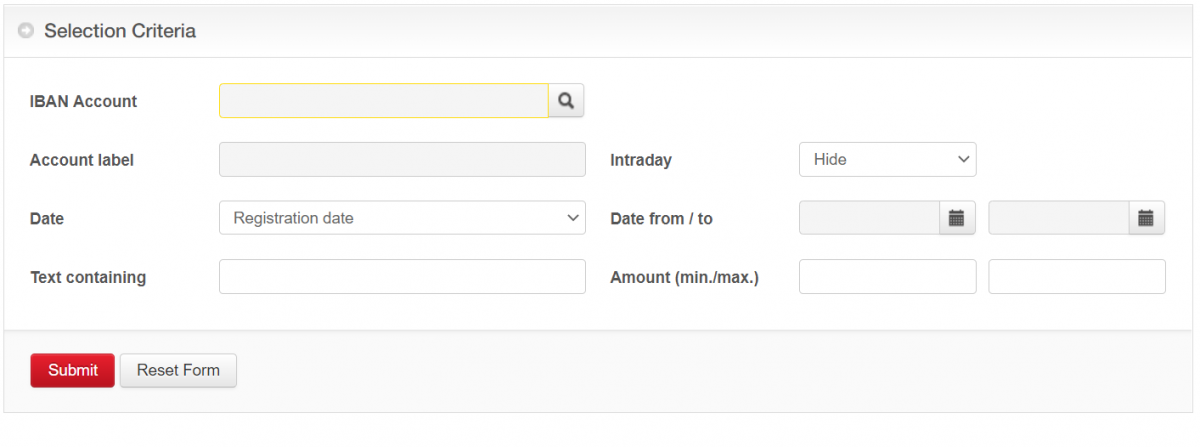

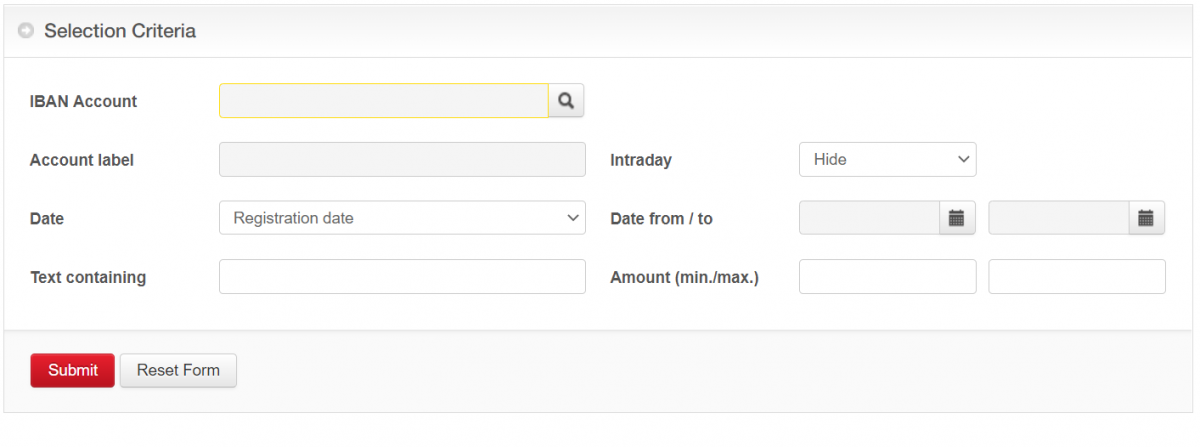

Those of you that wish to print the statement for an interval can use the Transactions menu for this. To download such a statement in this menu, you must select only the IBAN account and the starting / ending date of the chosen interval (Date from / To), as you can view i n the below picture. In the end, you have to press the Submit button.

In order to get the statement, it is important not apply in the Transactions menu more than the above selection criteria. Ending date of the selected interval for the statement will always be prior to the current date, since the statement is printed only for closed days and intraday transactions are not part of the statement. Thus, in the banking days, you can select maximum the previous day as ending date for the statement interval, while in the non-banking days, ending date of the interval of the statement can be at most the previous day before the last working day, no matter if this day is a banking or non-banking one. Printing the statement will be made by using the PDF button, which is available in the Transactions menu after selection.

From the PDF file, the report can be send to the printer. Downloading the statement for more than one month through a single selection must be avoided.

You can sign transactions from the BRD@ffice site or from the BRD@ffice Mobile app with the physical token or with M-Token (mobile software token), depending on the authentication method that you are using.

No matter the way you sign, you have the possibility to sign multiple transactions together. You can find details in the published manuals in BRD@ffice Mobile and/or BRD@ffice site or by contacting the support team.

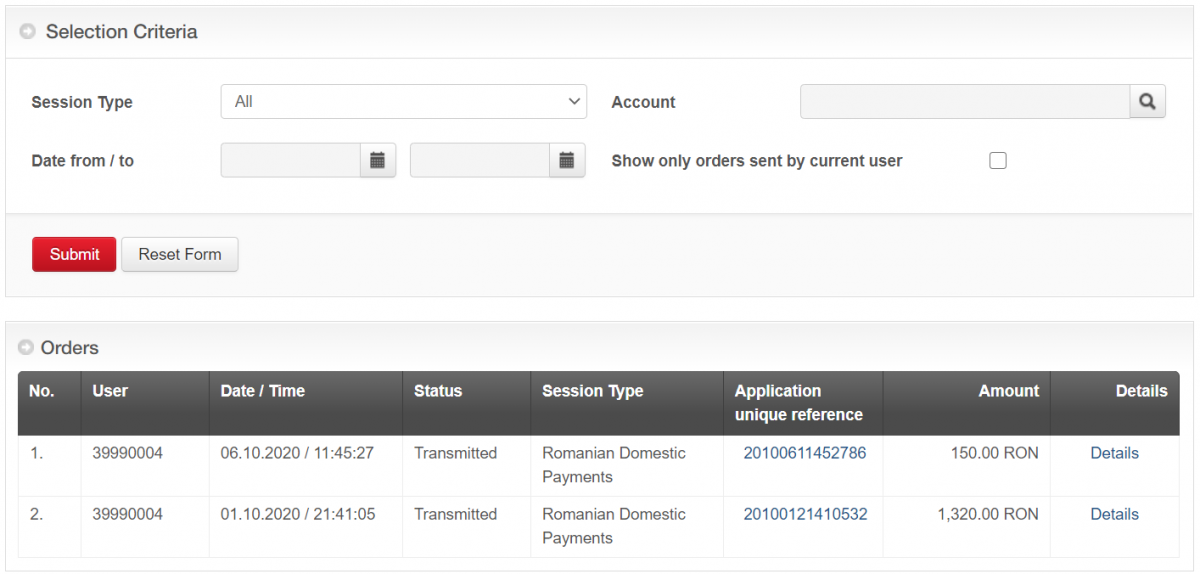

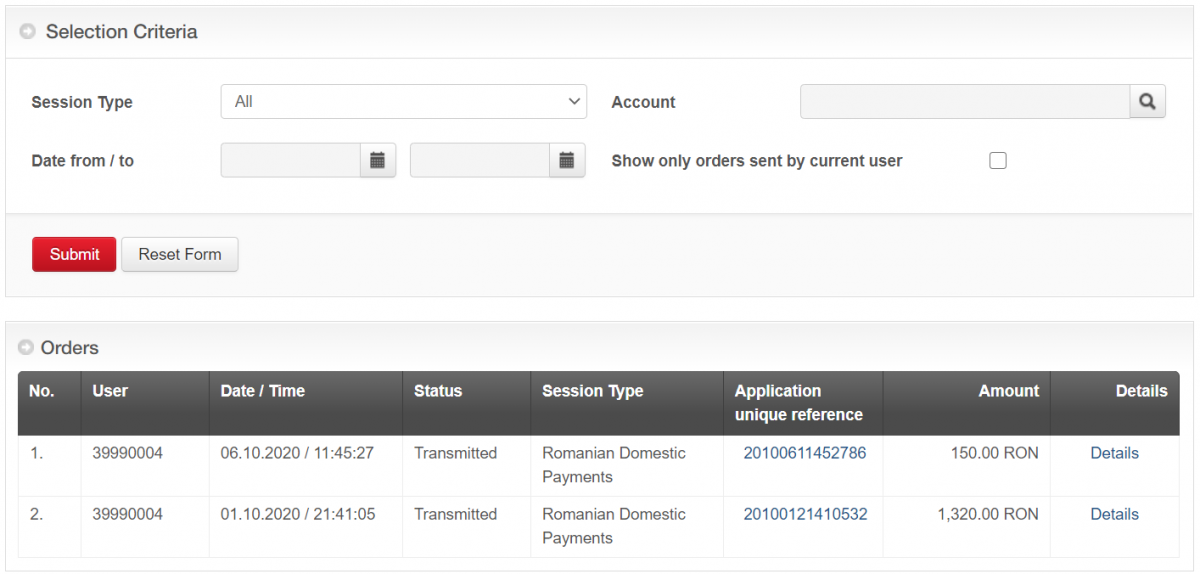

You have to use the Reporting → Operations status menu and after that to select the account for which you will do the search or to directly press the OK button. To view the status of a transaction, the link in the Application unique reference column will be use.

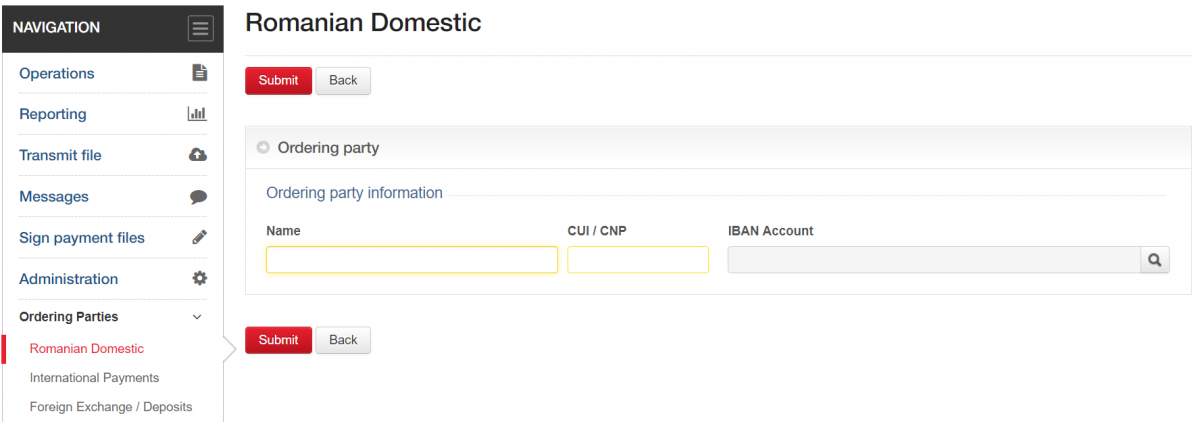

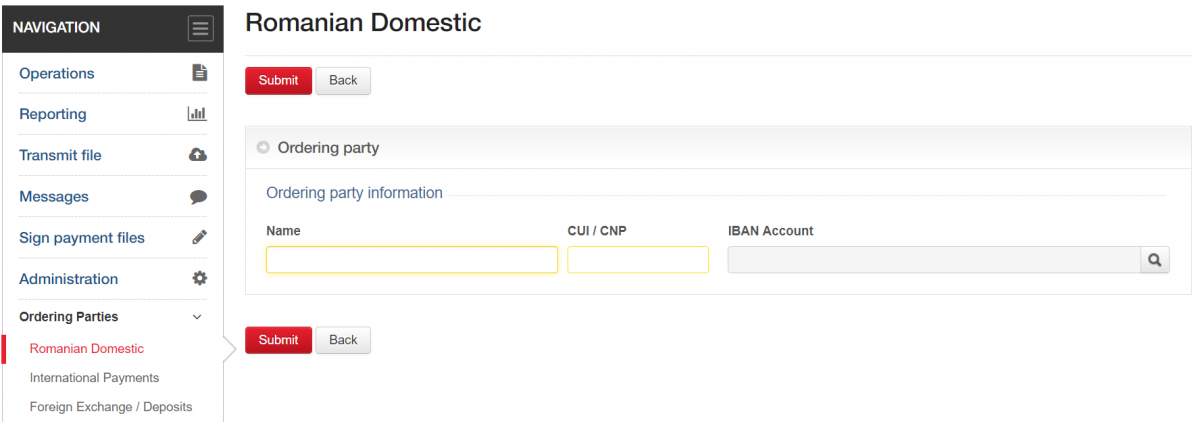

You have to register your company as ordering party in the submenus of the Ordering Parties menu: Romanian Domestic, International Payments and Foreign Exchange / Deposits. You only have to register one time each ordering party.

This will allow you to manage the beneficiaries in public list, that is displayed to all the users that are set on your company’s contract, or in private list, that is displayed only for the user that have created those beneficiaries.

The BRD@ffice allows using a single authentication method for each user, either with the physical token, or with M-Token.

Yes, the M-Token app can be installed on multiple devices, but please ensure yourself that the access to these devices can be made only by the authorized user. An M-Token license can be installed on maximum eight different devices.

Yes, several types of payment files can be imported: both domestic payments in RON and international payments. You can get further details by contacting the Help Desk Cash Management support service, by using the contact data placed on the site.

Yes, the users can choose to modify the authentication method and use of the new M-Token. If you want to modify your authentication method, please contact your bank officer.

Yes, BRD@ffice Mobile users having signature rights can directly sign transactions initiated through the BRD@ffice site/MultiX from the app installed on the mobile phone/tablet.

We would like to remind you that BRD - Groupe Societe Generale has not requested and will never ask any of your authentication data (user code, password or password token) or confidential information related to your card (card number, expiration date, security code or PIN) by phone, nor e-mail or SMS.

These confidential data will be used only for the internet banking authentication or for online payments.

At the same time, if you notice a different appearance of the usual MyBRD Net application (ex. A notification message that the page is unavailable and you are invited to log in again, or to sync your token device), please stop the authentication process immediately and contact as soon as possible through MyBRD Contact tel: 021 302 6161.